Qatar Gratuity Calculator 2026: Fast & Accurate Online

End-of-service gratuity in Qatar is a type of payment or reward provided by an employer to an employee in accordance with Qatari labor law. The amount of the gratuity depends on the length of service with the company, the employee’s salary, the labor law, and company policy.

Table Of Contents

- 1 Qatar Gratuity Calculator

- 2 What is The Gratuity in Qatar

- 3 How to Use Gratuity Calculator in Qatar

- 4 How to Compute Gratuity in Qatar

- 5 Example of Gratuity Calculation in Qatar

- 6 Gratuity Calculation in Qatar After 5 Years

- 7 Gratuity Calculation in Qatar After 10 Years

- 8 Factors Affecting the Gratuity Amount in Qatar

- 9 Eligibility for Gratuity in Qatar

- 10 Can Employer not Paying Gratuity in Qatar

- 11 Gratuity in Qatar for the Government Sector

- 12 Gratuity in Qatar for Housemaid

- 13 Questions & Answers

Qatar Gratuity Calculator

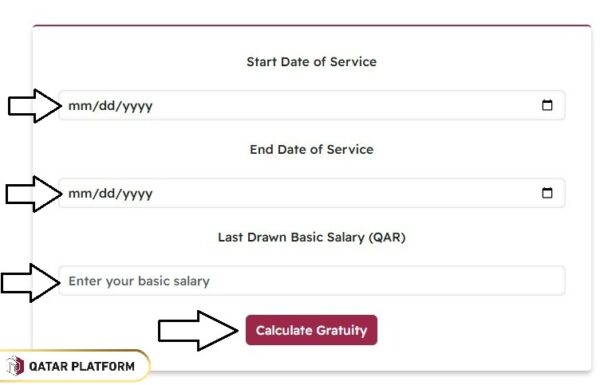

Below you can calculate your end-of-service gratuity according to Qatar Labor Law using the following calculator:

What is The Gratuity in Qatar

According to the Labor Law, Labor Law No. 14 of 2004 addresses this condition in Article 51. This article stipulates that an employee may terminate an employment contract before its expiration date if the employment period is for a fixed term and without giving reasons. However, if the contract is for an indefinite term, the employee has the right to terminate his employment and receive his full right to an end-of-service gratuity.

How to Use Gratuity Calculator in Qatar

You can use Qatar Gratuity Calculator to calculate your end-of-service gratuity online, follow these simple steps:

- Step 1: Select your Start Date of Service from the calendar.

- Step 2: Select your End Date of Service from the calendar.

- Step 3: Enter your Last Drawn Basic Salary (QAR).

- Step 4: Click “Calculate Gratuity“.

How to Compute Gratuity in Qatar

Gratuity in Qatar is calculated based on the employee’s last basic wage, here’s the formula:

- Gratuity = (Last Basic Monthly Salary ÷ 30) × 21 × Number of Years Worked

Example of Gratuity Calculation in Qatar

Let’s assume that:

- Your last basic monthly salary: QAR 5,000.

- Your total years of service: 5 years.

You can calculate your Gratuity as follows:

- Daily wage = 5,000 ÷ 30 = QAR 166.67.

- Gratuity for one year = 166.67 × 21 = QAR 3,500.

- Total gratuity for 5 years = 3,500 × 5 = QAR 17,500.

Gratuity Calculation in Qatar After 5 Years

Here is a simple formula to calculate gratuity in Qatar after 5 years:

- Basic salary/30 (one month) X 21 days (three weeks) x Year.

- For example: Suppose you work in a company for 2 years and your salary is 2000 QAR, then:

- QAR 2000 ÷30 = QAR 66.66 (one day salary)

- QAR 66.66 x 21 = QAR 1,400 (21 days salary)

- QAR 1,400 x 2 = QAR 2,800 (your total of 2 years bonus)

Gratuity Calculation in Qatar After 10 Years

The end of service gratuity after 10 years is also the same as the one-year end of service gratuity, as the rule of giving a one-week gratuity is no longer valid. Each employee receives a 5-week gratuity.

Factors Affecting the Gratuity Amount in Qatar

The following factors affect the calculation of the end-of-service gratuity in Qatar:

- Partial years: For employees who have completed more than one year but less than one full additional year, the end-of-service gratuity is calculated proportionally based on the months they have completed.

- Resignation before completing one year: An employee is not entitled to an end-of-service gratuity if they leave their employment before completing one year of service.

- Contract provisions: If the employment contract provides for a more favorable calculation of the end-of-service gratuity, the terms of the contract apply.

- Deductions: Any loans, advances, or entitlements owed by the employee to the employer may be deducted from the end-of-service gratuity amount.

Eligibility for Gratuity in Qatar

To qualify for end-of-service gratuity in Qatar, an employee must:

- Complete at least one year of continuous service with the employer.

- Resign or terminate employment.

- Ensure that no serious violations or misconduct have been committed that would lead to termination of employment.

Can Employer not Paying Gratuity in Qatar

An employer may terminate an employee’s service in the following cases:

- If the employee presents a false identity, a false nationality, or forged documents.

- If the employee commits an act that results in a loss to the employer, the employer must report all incidents to the administration within 24 hours.

- If the employee is sentenced to life imprisonment for a crime or indecency.

- If the employee is absent from work without an acceptable excuse for a period of 7 days and 15 days per year.

- No mandatory penalty may be imposed on an employee for a single violation, and no more than one penalty may be imposed.

- If the employee assaults the employer, their manager, or any other employee during the course of work.

- If the employee reveals secrets of the company or the employer they work for.

- If the employee fails to perform their work on one or more occasions, they have the right to terminate their employment under the contract.

Gratuity in Qatar for the Government Sector

The method for calculating end-of-service gratuity in Qatar differs between the government and private sectors, and depends primarily on the number of years of service. As the number of years of service increases, the method of calculating the end-of-service gratuity changes, as does its value, as follows:

Calculating Gratuity for the Government Sector in Qatar before 5 Years

The following equation explains how to calculate end-of-service gratuity for the government sector in Qatar before 5 years:

- End-of-Service Gratuity = One Month’s Salary × Number of Years of Service

Calculating Gratuity for the Government Sector in Qatar after 5 Years

The following equation explains how to calculate end-of-service gratuity for the government sector in Qatar after 5 years:

- End-of-Service Gratuity = (One Month’s Salary × 5) + (One Month’s Salary × 1.5 × Number of Years Remaining After the First 5 Years of Service)

Calculating Gratuity for the Government Sector in Qatar after 10 Years

The following equation explains how to calculate end-of-service gratuity for the government sector in Qatar after 10 years:

- End-of-Service Gratuity = (One Month’s Salary × 5) + (One Month’s Salary × 1.5 × 5) + (One Month’s Salary × 1.5 × 5) (One Month’s Salary × 2 × Number of Years Remaining After the First 10 Years of Service) (Service)

Gratuity in Qatar for Housemaid

A domestic worker in Qatar is entitled to an end-of-service gratuity if they terminate their employment after one full year of service with the same employer. This gratuity must not be less than three weeks’ wages for each year, including fractions of a year. In other words, the value of the end-of-service gratuity paid to a domestic worker is the same as the value of the end-of-service gratuity paid to a private sector worker.

Conclusion

An employee is entitled to an end-of-service gratuity upon termination of service and registration if the worker has worked for the company for at least one year or more. Therefore, the company is supposed to pay you the end-of-service gratuity in accordance with Article 1. The company handles all the procedures and gives you the gratuity amount at the end of service.

Questions & Answers

How gratuity is calculated in Qatar?

Gratuity = (Number of years of service) × (Last drawn basic salary) × (Minimum of 21 days for each year of service).

Can I get gratuity if I resign Qatar?

Yes, you can get gratuity if you resign Qatar.

What is the new law for gratuity in Qatar?

The updated law now grants three weeks' gratuity per year.

Can employer terminate an employee's service without paying gratuity?

Yes, employer can terminate an employee's service without paying gratuity.